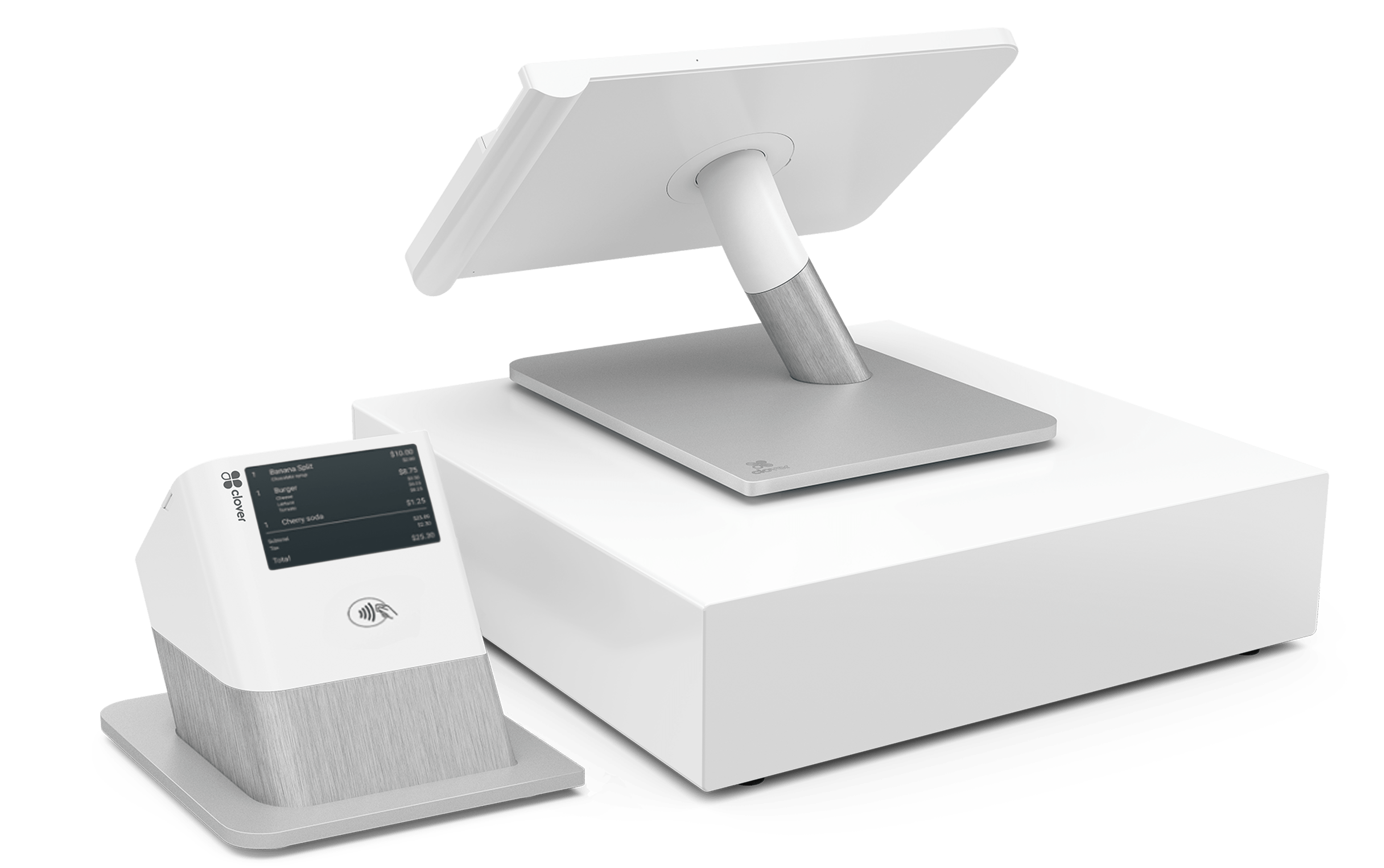

Prior to refinancing your vehicle mortgage, you need make sure you explore their aspects of refinancing, the worth of the car additionally the overall cost. Visualize Borrowing from the bank: Shutterstock

Dubai: Increasing rates of interest have left of a lot automobile buyers caught with large finance and higher monthly installments. But with rates of interest getting lower dramatically now – and a lot more incisions take the latest views, is it possible you stand-to acquire out-of refinancing your existing car finance now?

Refinancing is the process of substitution one or more established funds with a brand new you to, usually owing to a separate lender. However, did you know you are doing a similar having a great car loan?

Since the car repayments shall be a significant amount of funds, once you have funded the car, you may want to getting stuck and committed to the phrase of your own auto loan and you may percentage. not, it doesn’t should be the actual situation.

Car finance refinancing can help you alter pretty much every part of your car or truck loan – identity, rates, charges, etcetera. Nonetheless it you will definitely come at a cost and possible large matter regarding full paid down attention for many who expand the loan label.

However, with pricing dropping there’s a lot way more to look at than what are you doing with rates with the main financial peak.

Just before refinancing your car or truck loan, need make sure you check out their reasons for having refinancing, the value of your vehicle additionally the overall cost, told me Ibrahim Riba, an elderly auto insurance and you may loan salesperson based in Abu Dhabi. Here are a few conditions you will want to believe before you could get yourself started it.

Why you should re-finance my car mortgage?

1. You’ve probably got a higher rate initial and from now on your own lender has to offer a very aggressive rate due to the fact prices has been coming down adopting the previous speed slash.

2. We need to spend your vehicle out-of ultimately, however you don’t want to pay focus or punishment having early payment.

step three. We wish to decrease your payment. If you expand the loan on the an extended title, you might score a lowered payment per month, especially if you lock-inside the a lesser interest americash loans Brewton.

Even though pricing have not changed, enhancing your credit history can be sufficient to get a lesser rates. The greater their borrowing from the bank, the more favorable mortgage terminology you get, extra Riba. If you’ve enhanced your credit rating as signing for your first mortgage, you can even qualify for greatest loan terms.

Which are the will cost you you should weigh?

Whenever you are contrasting various car refinance also offers, you really need to lookup outside the cited rates additionally the potential payment per month, said Jacob Koshy, good Dubai-built automobile globe expert, currently providing services in during the retail cost and just how interest levels can affect them.

Just before refinancing, also consider if charge have a tendency to impact your current discounts. By way of example, your existing car finance have an excellent prepayment penalty in place. And additionally assess the overall focus over the lifetime of the borrowed funds.

Refinancing towards the a lengthier identity loan you will suggest your a good financing and you will payment will be higher than the worth of your car or truck. Regardless of if a lender can get allow this to occur, eliminate it. You dont want to enter a posture in which you commonly need to put extra money in to settle your vehicle financing if you have to sell it.

Thus in short, while you are refinancing is a great treatment for offer the loan term, dont meet or exceed what is practical for the car worthy of.

What are the other dangers to consider?

When your goal of refinancing an auto loan would be to shell out it off smaller, enable you to financial discover. They’re in a position to exercise a great deal to you personally which is exactly like refinancing with no costs that is included with using up a different loan out-of an alternate bank, additional Riba.